How to Cash a U.S. Postal Money Order in the Philippines

U.S. Postal Money Orders offer a secure way to send money. They are widely accepted and can be cashed at various locations. Understanding their use in international contexts, particularly in the Philippines, is crucial. This section will provide an overview of what postal money orders are and their advantages over other payment methods. It will also address common misconceptions about cashing these orders abroad.

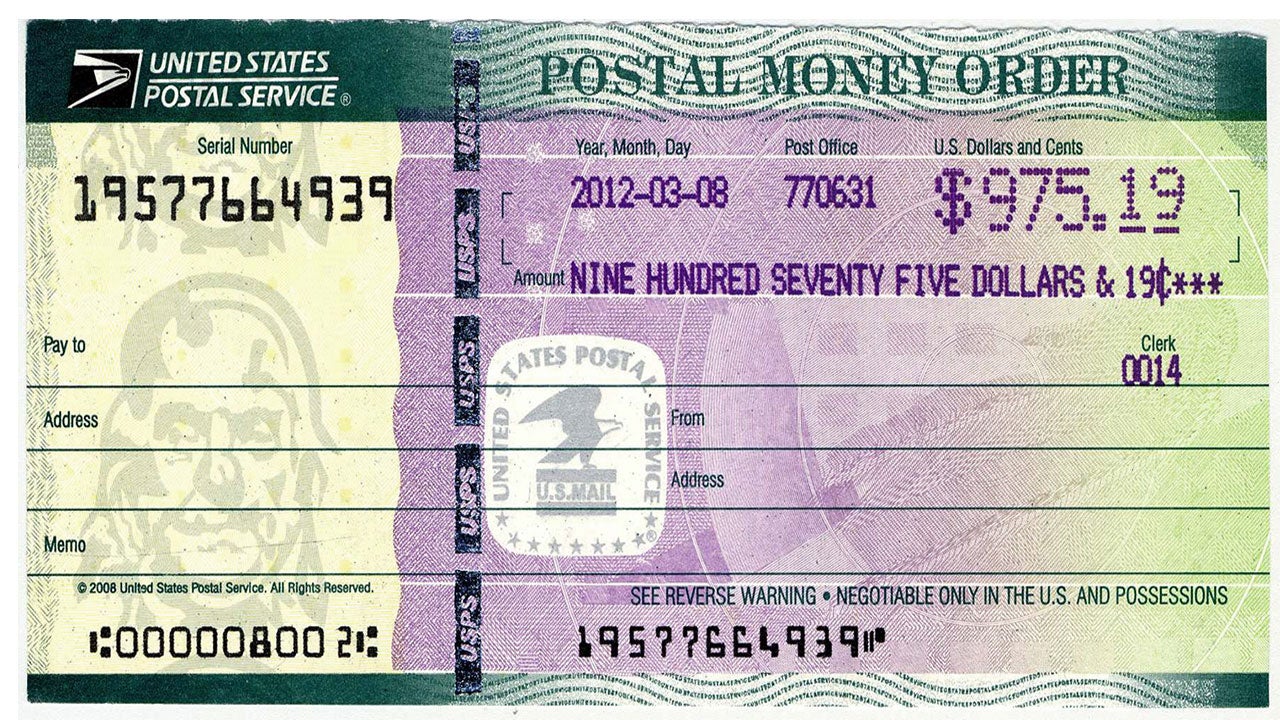

Introduction to U.S. Postal Money Orders

U.S. Postal Money Orders are a trusted financial instrument used for sending money safely across distances. They function similarly to checks but are prepaid, meaning the funds are guaranteed. This makes them a reliable option for those needing to transfer money, especially internationally. In the Philippines, these money orders can be cashed at designated banks, post offices, and some retail locations. Unlike personal checks, which may bounce, money orders offer added security and peace of mind. One common misconception is that cashing a U.S. Postal Money Order is straightforward anywhere. However, acceptance can vary by location, and not all financial institutions are equipped to handle them. Understanding the nuances of cashing these orders abroad is essential for a seamless experience. Additionally, it’s important to note that while they are a secure payment method, potential fees and exchange rates can impact the total amount received.

Finding the Right Location to Cash a Money Order

Cashing a money order requires knowing where to go. In the Philippines, major banks, credit unions, and post offices are the primary places to start. When searching for a location, it’s beneficial to check with well-known banks that have a history of accepting U.S. Postal Money Orders. Larger branches often have the staff and resources to process these orders without issue. Before heading out, it’s advisable to call the selected location to verify they accept U.S. Postal Money Orders. This can save time and prevent unnecessary trips. Additionally, if you plan to cash a significant amount, opting for larger branches is wise, as they are more likely to have the necessary cash on hand. It’s also worth considering the proximity of the location to your residence or workplace, as convenience can greatly enhance the overall experience.

Required Documentation for Cashing

Proper identification is essential when cashing a money order. Most institutions will require at least one form of government-issued ID, such as a passport or a driver’s license. It’s important to ensure that the ID is current and valid. Some places may also ask for additional documentation, such as proof of address or a secondary form of ID. Creating a checklist can enhance clarity and ensure you have all necessary documents before heading to the cashing location. This checklist might include:

- Passport or government-issued ID

- A secondary form of ID (e.g., a student ID or utility bill)

- The U.S. Postal Money Order itself Presenting valid ID is crucial for security and compliance, as it helps institutions verify your identity and prevent fraud. Being prepared with all necessary documentation can streamline the cashing process, making it quicker and more efficient.

Understanding Fees and Exchange Rates

Cashing a money order may involve various fees and exchange rates. Each financial institution has its own fee structure, which can significantly impact the total amount you receive. Some banks may charge a flat fee, while others might take a percentage of the transaction. It’s essential to inquire about these fees upfront to avoid surprises. Additionally, understanding exchange rates is crucial when converting U.S. dollars to Philippine pesos. Rates fluctuate based on market conditions, so it’s wise to check the current rate before cashing your money order. Some banks offer competitive rates, while others may charge higher fees for currency conversion. Doing a bit of research can help you make informed decisions regarding the cost of cashing your money orders.

Alternatives to Cashing Money Orders

When cashing a money order proves challenging, alternative methods exist. Services like wire transfers may offer a faster and more convenient solution. Companies such as Western Union and MoneyGram provide options for sending and receiving money internationally, often with fewer barriers than cashing a money order. While these alternatives can be beneficial, they also come with pros and cons. Wire transfer services typically charge fees, which can vary significantly based on the amount sent and the destination. In some cases, these services may provide instant access to funds, which can be a considerable advantage. However, if you prefer the security of a money order, weighing the benefits against the costs is essential.

Steps to Cashing a Money Order Successfully

A step-by-step guide can simplify the process of cashing a money order. Begin by locating a suitable place that accepts U.S. Postal Money Orders. Once you have identified a location, prepare your documentation, ensuring you have valid ID and the money order itself. Next, plan your visit. Choosing the best time to go can make a significant difference; visiting during non-peak hours often means shorter wait times. When you arrive, approach the teller and present your money order along with your identification. Be patient during the process, as there may be additional verification steps. It’s important to remain calm and courteous, especially if any challenges arise. If the process takes longer than expected or if there are any issues, having a prepared mindset can help you navigate these situations more smoothly.

What to Do in Case of Issues

Occasionally, issues may arise when cashing a money order. Common problems include lost or stolen orders, which can be stressful. If you find yourself in this situation, it’s crucial to contact the U.S. Postal Service immediately for assistance. They can guide you through the process of replacing a lost money order or handling a stolen one. Keeping receipts and documentation for your transactions is also important. These records can serve as proof of your cashing attempts and may be needed if disputes arise with the institution. If misunderstandings occur at the cashing location, approach the situation calmly and seek clarification from the staff. Providing clear information and remaining respectful can often resolve issues more effectively.

Conclusion and Final Tips

In conclusion, cashing a U.S. Postal Money Order in the Philippines is feasible with the right knowledge. Understanding the process, from finding the right location to preparing the necessary documentation, is key to ensuring a smooth experience. Always check the latest policies of the institutions where you plan to cash your money order, as regulations and procedures may change. Maintaining open communication with cashing locations can also help alleviate concerns and clarify any uncertainties. Staying informed and proactive empowers you in your financial transactions, making the process of cashing money orders in the Philippines a straightforward task. For more detailed information on U.S. Postal Money Orders, you can refer to the U.S. Postal Service.